FinAI: Simplifying Stock Research with AI — A UX Case Study

About the project

Date:

Oct 9, 2025

Client:

Veeru Patil

My Role:

UI UX Designing

Problem Statement

Many people interested in investing and personal finance struggle to research stocks efficiently due to scattered information, complex financial terms, and unclear insights. Switching between multiple platforms for data, learning, and decision-making makes the process slow, confusing, and discouraging for both beginners and experienced investors

Problem Context (Background)

During college, a friend who actively invested in stocks often shared how frustrating it was to gather reliable data, understand financial concepts, and make quick decisions across different platforms. His idea of solving this as a startup later motivated me to take up this project as a UX design case study.

With growing interest in stock markets and personal finance, users rely on multiple platforms for research, learning, and recommendations. This fragmented experience creates confusion, information overload, and low confidence in decision-making

My Tasks & Challenges as a UX Designer

Understanding real investor pain points and turning scattered needs into one clear product vision.

Simplifying complex financial data so it feels approachable, not overwhelming.

Designing multiple AI flows that feel connected, not confusing.

Balancing powerful features with a clean, easy-to-use interface.

Creating a fair credit system without disrupting the user experience.

Ensuring trust and transparency in a product that deals with financial decisions.

Key Objectives

Build a simple and powerful company analysis experience with clear charts, fundamentals, financials, and recent news in one place.

Design a smart side-by-side comparison feature so users can easily compare multiple stocks without losing context.

Create an intuitive watchlist system to help users track, organize, and monitor their favorite companies effortlessly.

Deliver clean infographics and easy-to-read charts that simplify complex financial data for quick understanding.

Develop three focused AI models: one for general finance queries, one for detailed stock data visualization, and one for intelligent stock suggestions.

Ensure a smooth and connected user flow between all AI tools so users can move from learning to analysis to action seamlessly.

Build trust and confidence through transparent data presentation, credit usage clarity, and responsible AI guidance.

My Research Uncovers

Target Customers

Beginner investors who want simple and guided entry into stock market investing.

Retail traders who actively track prices and make short-term trading decisions.

Long-term investors focused on fundamentals, stability, and portfolio growth.

Finance students & learners who need easy explanations of complex financial concepts.

Working professionals who want quick insights without spending hours on research.

Data-driven users who rely heavily on charts, ratios, and historical performance.

Side-hustle investors who invest part-time and need fast, reliable information.

User Interview

The initial problem was first noticed by a close college friend who actively invests and shared his struggles with scattered data and unclear insights. After creating a rough solution idea together, I interviewed a few friends who regularly invest in stocks and startups. I also used ChatGPT as a normal investment user to simulate real user behavior and questions

User Pain points

Scattered – Users jump between multiple apps for charts, fundamentals, and news, which makes research slow and tiring.

Confusing – Financial terms and ratios feel hard to understand without simple explanations in one place.

Time-consuming – Comparing companies manually across different platforms takes too much effort and time.

Tracking – Users struggle to properly monitor shortlisted stocks without a clean watchlist system.

Overloaded – Too much raw data at once makes it difficult to know what actually matters.

Uncertain – Users often lack confidence in their decisions due to unclear insights and mixed information.

Disconnected – Learning about finance, analyzing companies, and finding suggestions all happen on separate tools.

Limited – Free users feel restricted when daily usage ends without a smooth way to continue

User Behavior & Usage Patterns

Frequent company searches before buying or selling any stock.

Heavy use of comparison features to evaluate similar companies side by side.

Regular watchlist monitoring to track favorite stocks throughout the day.

Quick AI queries to clarify doubts during decision-making moments.

Preference for visual data like charts, infographics, and trends over long text.

Goal-oriented browsing, often driven by profit, stability, or learning.

Repeated short sessions instead of long research sessions.

Higher engagement during market hours and major market news events

Ideation Process

My ideation process started with understanding the real user problems shared by my friend and validating them through conversations with a few active investors. Once the core needs were clear, I began listing all possible features without any limitation.

After that, I filtered ideas based on three main constraints: development time, budget, and availability of reliable APIs. Many advanced ideas were dropped or postponed after realizing their technical and cost complexity.

The goal was to design a product that feels powerful yet realistically buildable for an early-stage startup. I focused on features that deliver the maximum user value with minimum system complexity, while keeping the experience smooth and scalable for future upgrades

Stock Research with FinAI

This flow is carefully designed to reduce confusion, build confidence, and help users move smoothly from curiosity to clarity. Every interaction supports real investment behavior — from exploring a stock to comparing options and saving decisions for later

Company Search & Visual Data to help users quickly understand financial health without feeling overwhelmed.

Side-by-Side Comparison to support confident decision-making between similar stocks.

Watchlist Saving to help users track and revisit potential investments without pressure to act instantly.

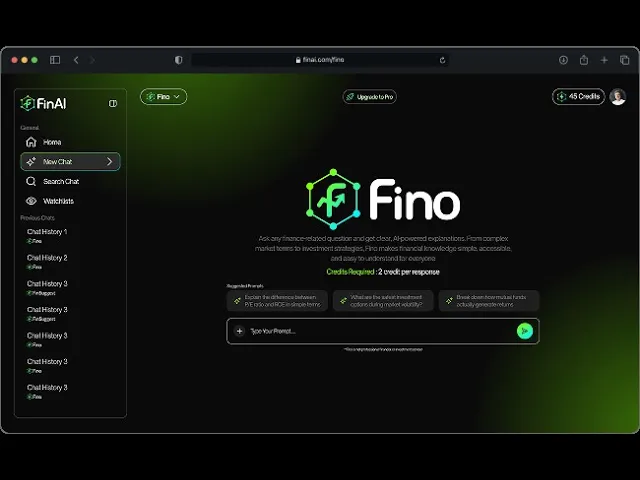

Fino & Subscription Flow

This flow is designed to support curiosity without friction, guide users when they feel stuck, and gently convert them only when real value is experienced. Learning, limits, and upgrades are connected in a natural, non-forced way.

Fino chat flow to help users understand finance in simple language without feeling judged or overwhelmed.

Credit limit interruption to create a clear usage boundary without breaking trust.

Upgrade & purchase flow to give users control to either continue instantly or unlock long-term value.

Fin Suggest Flow

This flow is designed to help users move from uncertainty to action with minimal effort. It supports discovery, quick evaluation, and safe decision-keeping through a smooth mix of AI suggestions, instant details, and tracking tools.

AI stock suggestion table to reduce manual filtering and scanning across platforms.

Row-level stock popup to give instant clarity without breaking the browsing flow.

Watchlist integration to help users save ideas without pressure to invest immediately.

Smart Watchlists for Effortless Tracking

This watchlist experience helps users organize, monitor, and revisit their stock ideas without pressure. It turns scattered interests into a structured tracking system, so users can observe performance calmly before making any real investment decisions.

Lets users separate short-term ideas from long-term plans using groups.

Helps users track multiple stocks at a glance without opening each one.

Supports quick actions like Ask Fino, Compare, or View Details from one place.

Reduces mental load by keeping all saved research in one organized space

Final Prototype

Click to play the prototype's video

My Learnings & Takeaways as a UX Designer

This project taught me how to balance real user needs with technical and business constraints while designing a complex AI-based product. It pushed me to think deeply about clarity, trust, and long-term usability across different user mindsets.

I learned how to simplify complex financial data without losing its meaning.

I understood the importance of small UX decisions in building user trust.

I improved my skill in designing multi-AI flows as one connected experience.

I realized how pricing, credits, and upgrades directly shape user behavior.